To ease the process of separating, please review the following materials:

Initiating a Resignation Notification in Workday

1. Log into Inside.sou.edu and access OKTA.

2. Within OKTA, access the Workday Production Application.

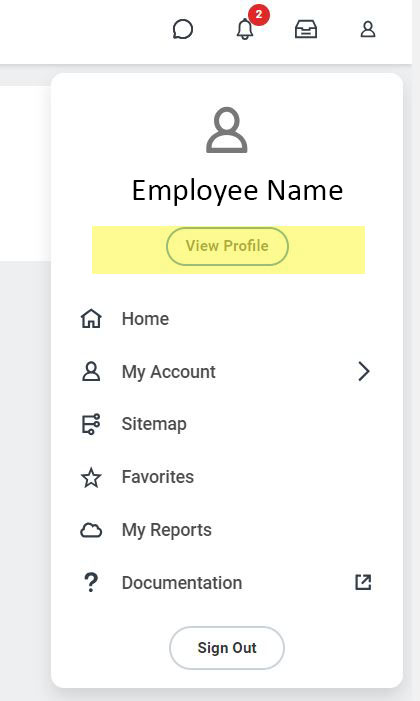

3. In Workday, Access your Worker Profile

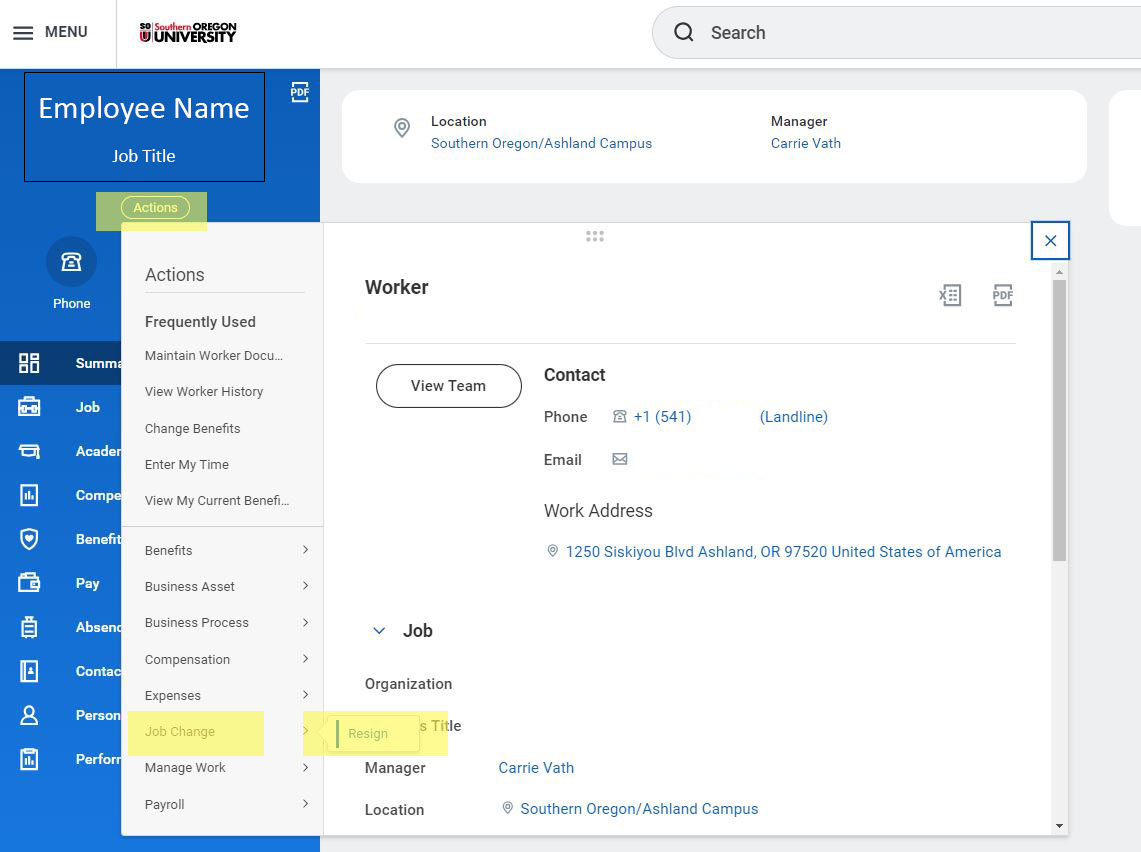

4. Next, take Action to Change Job and prompt the Resignation notification process.

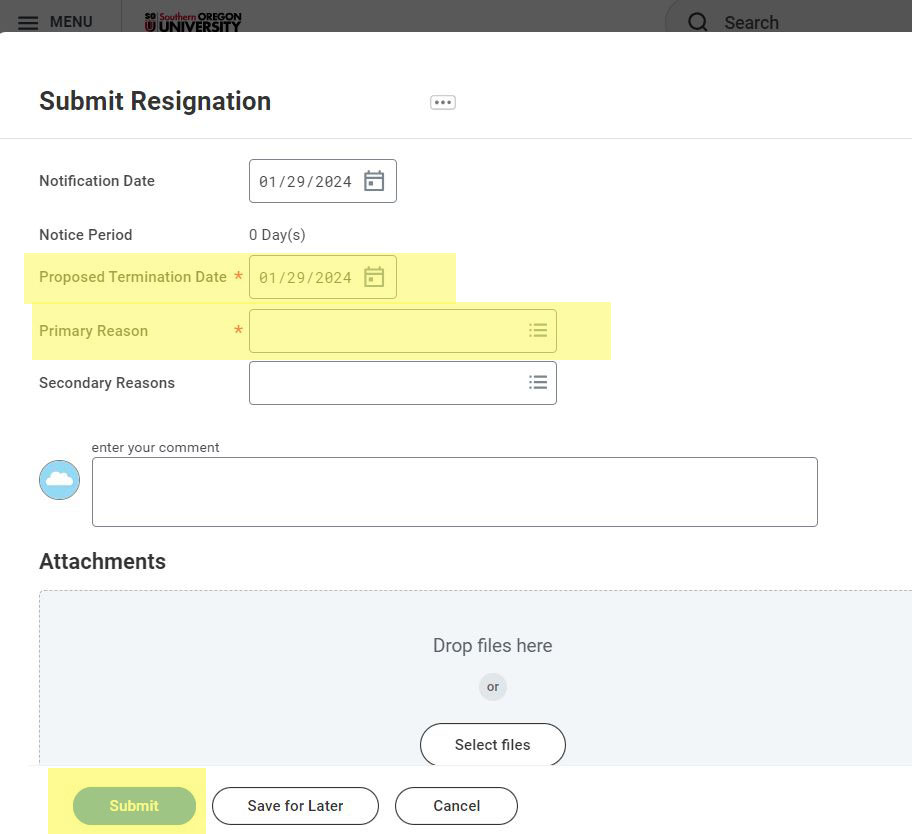

5. You will then be prompted to fill out a few fields.

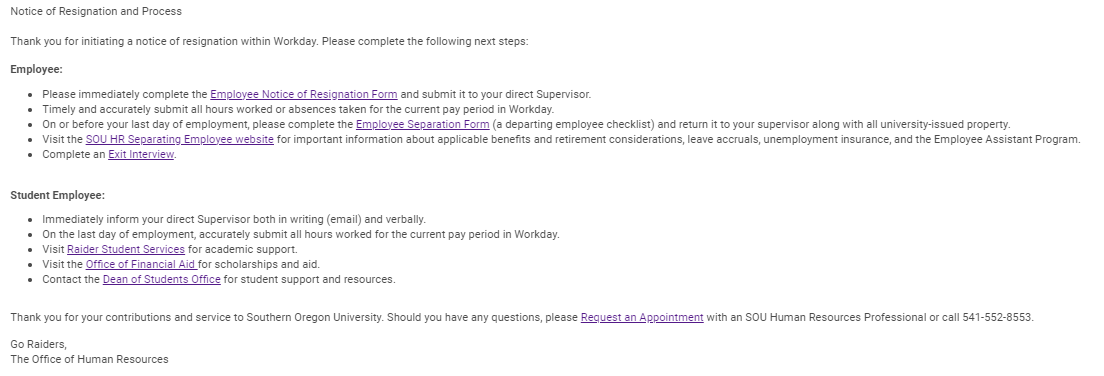

6. When finished, both you and your supervisor will receive a Workday notification similar to the following:

Required Forms for Separation

Required Forms for Separation

- Resignation/Transfer Form, to be submitted at the time of resignation

-

Employee Separation Form, to be submitted to HR on the last day physically on campus, include final leave or timesheet

Final checks are issued within a week of separation, or by normal payday, whichever comes first, unless otherwise stated. Paper checks are picked up at Payroll Services (Churchill Hall - Room 143, 1250 Siskiyou Boulevard, Ashland) and ID is required.

Benefit Considerations

-

If the employee has at least 80 hours of paid work in their final check, benefit premiums will be automatically taken, which will allow coverage through the end of the following month. If the employee has less than 80 hours of work in their final check, benefits will then terminate at the end of the month the employee resigned. Some optional benefits are portable, meaning you can continue to pay for the benefit by working with the subscribing company. Detailed information can be found in the PEBB Plan Summary.

-

-

Optional Life Insurance (including $10k guaranteed issue life insurance included in Core benefits): If your employment ends, you may be eligible to continue your Optional Life coverage. You must apply and pay premiums within 30 days after SOU group coverage ends or is reduced, by contacting The Standard, 1-800-842-1707, Policy number 606814-D and the policyholder is 'The State of Oregon by and through its Public Employee's Benefit Board.

-

Dependent Life Insurance: This insurance of $5,000 guarantee issue coverage to dependents is not portable or convertible and will terminate on the last day of coverage.

-

Short and Long-Term Disability Insurance: Disability insurance is not portable or convertible and will terminate on the last day of coverage.

-

Accidental Death & Dismemberment Insurance: AD&D insurance is not portable or convertible and will terminate on the last day of coverage.

-

Health and Dependent Care Flexible Spending Accounts (FSA's): FSA's will stop at the end of the month in which you terminate employment. The money contributed will remain in the FSA account and can be used to cover qualified expenses, which must have been incurred while working in a qualified position. FSAs may be continued after separation through COBRA. The right to elect to continue FSA's ends 90 days from the date coverage terminates. Continuation of coverage will not extend past the current plan year. If electing to continue with COBRA through the end of the calendar year, FSA will be then paid on a post-tax basis.

-

Long-Term Care: If your group long-term care coverage ends, for reasons other than your choice to have premium payments stopped for your coverage, you may elect converted coverage. This means that the coverage you had under this plan can continue on a direct billed basis. An election for converted coverage must be made within 60 days of the date the group coverage would otherwise end. Any premium that applies must be paid directly to UNUM by you for any converted coverage to be continued. UNUM can be reached at 1-800-227-4165 or at the UNUM website, certificate number 025858 with Oregon Public Employee's Benefit Board as the policyholder.

-

- If separating due to retirement, employees may look to the following programs to continue health coverage, other programs may be available:

- COBRA (Consolidated Omnibus Budget Reconciliation Act), a federal law that allows the employee to pay out-of-pocket for the same PEBB medical, dental, and vision currently available at SOU. Optional benefits are not continued through COBRA, though some are portable, as described above. More information about COBRA can be found on HR's COBRA webpage.

- The Health Exchange Insurance Marketplace is available to those who do not have employer-sponsored health insurance. The Health Exchange has plan options that you can choose from to meet your and your family's needs. Depending on income, health insurance may be available at a reduced cost or even free. Oregon residents can look to the Oregon Health Exchange for details and non-Oregon residents can look to the federal governments Healthcare.Gov webpage for details.

- If separation is due to retirement, employees will need to take action to continue health coverage or to enroll in new program(s). Below are helpful programs that may be available to you:

- PERS Health Insurance Program (PHIP) is available to eligible PERS retirees and their dependents. New PERS retirees and their eligible dependents must enroll with PHIP within 90 days of their PERS effective retirement date. PHIP offers plans that will bridge the gap to Medicare and plans that can act as supplement plans once enrolled in Medicare. For more details, review the PERSHealth.com website or contact PHIP directly.

- PEBB Retiree Health Insurance is available to PEBB members and their eligible dependents if the employee is retiring and under age 65 as this program is designed to bridge the gap to Medicare. The medical, dental, and vision plans available are the same as the active PEBB member plans. The PEBB Retiree Health Insurance Fact Sheet is helpful in understanding the program and more detailed information can be found on the PEBB webpage Coverage for Non-Employee GroupsCoverage for Non-Employee Groups

- Medicare is intended to provide healthcare coverage for those who are age 65 or older. Oregonians who need assistance with Medicare enrollment can look to a program through the State of Oregon called SHIBA (Senior Health Insurance Benefits Assistance), a free service with experts who can educate and assist you with Medicare. More details can be found on the State of Oregon's SHIBA website.

Benefit Contacts:

- Nicole Blodget, Benefits Officer 541-552-8553

- PEBB 503-373-1102

- Medical, Dental, and Vision Contact List

- The Standard 1-800-842-1707

- UNUM 1-800-227-4165

Retirement Considerations

Qualified employees will have a state-mandatory retirement account through PERS or the ORP. Any employee may also elect a retirement plan through the Tax-Deferred Investment 403(b) (TDI 403(b)) or Oregon Savings Growth Plan 457 (OSGP 457). If separating from SOU because you are retiring, please work with the Benefits Officer to ensure all necessary items are attended too. The SOU Retirement website has many helpful resources that may be considered, including the Retiree Checklist. If separating not due to a retirement and if vested (takes five years), accounts can remain intact, accruing interest until the employee reaches retirement age or withdrawals the account (withdrawals do void membership and cannot be undone).

-

State Mandatory Programs:

-

Public Employees Retirement System (PERS): If you are enrolled in PERS you are either in Tier 1, Tier 2 or OPRP (Oregon Public Retirement Program, consider as tier 3). PERS accounts take five years to vest and are available to members upon reaching normal retirement age or working 30 years of service. Choosing to take funds out of PERS is considered a complete account withdrawal and can only be done while not working for any PERS employer for at least 30 consecutive days. If PERS has been withdrawn from and an employee is eligible in the future, they will lose prior years of service and vesting and will begin again as a new member. Visit the PERS website for information about withdrawals or call 1-888-320-7377.

-

Optional Retirement Program (ORP): If enrolled with the ORP (unclassified employees only), as opposed to PERS, members are either with TIAA-CREF or Fidelity (Valic available to members enrolled prior to 2013). ORP accounts are available to members once no longer working for a PERS/ORP-eligible employer.

-

TIAA-CREF can be reached at 1-888-842-2888 or by visiting their website.

-

Fidelity can be reached at 1-800-343-0860 or by visiting their website.

-

Valic can be reached at 1-866-238-4896 or by visiting their website.

-

-

-

Employee Elected TDI 403(b) or OSGP 457 Programs:

-

Tax-Deferred Investment 403(b) (TDI 403(b)): If enrolled in the TDI 403(b) plan, employees will have access to your funds once no longer working for SOU. Employees elect to enroll in either TIAA-CREF or Fidelity, retirement investment companies that manage your funds, whom the employee works directly with after separating from SOU.

-

TIAA-CREF can be reached at 1-888-842-2888 or by visiting their website

-

Fidelity can be reached at 1-800-343-0860 or by visiting their website.

-

-

Oregon Savings Growth Plan 457 (OSGP 457): If enrolled in the OSGP 457, employees have access to funds once no longer working for SOU. OSGP 457 is managed by the State of Oregon, whom the employee works directly with after separating from SOU.

-

OSGP 457 can be reached at 1-888-320-7377 or by visiting their website.

-

-

Retirement contacts:

- Nicole Blodget, Benefits Officer 541-552-8553

- PERS 1-888-320-7377

- TIAA-CREF 1-888-842-2888

- Fidelity 1-800-343-0860

- Corebridge (Voya/Valic/AIG new program name) 1-866-238-4896

- OSGP 457 1-888-320-7377

Leave Accruals/Faculty Under or Overload

Vacation Leave

In accordance with the SOU Paid and Unpaid Leave for Unclassified Employees, an eligible unclassified administrator will receive a maximum payout of unused vacation leave upon separation of up to 180 hours.

In accordance with the SEIU CBA Article 43, an eligible classified employee who has completed their trial service period will be paid out unused vacation leave upon separation of up to 250 hours.

Academic Year faculty positions do not earn vacation leave.

Earned Compensatory Time Off

Non-exempt employees (both unclassified administrators and classified employees) will be paid out any unused earned compensatory time off (CTO) upon separation.

Sick Leave

In accordance with OAR 839-007 and ORS 653.601-653.661, sick leave is considered a wage replacement and not earned wages. Therefore, unused sick leave is not paid out at the time of separation.

In accordance with PERS or respective new employer policy, SOU employees who are hired at another institution within the former Oregon University System or to a State agency within two years of separation shall have unused sick leave credits restored.

Oregon Public Universities (OPU) Benefits/Accrual Verification Form

SOU employees who are hired at another Oregon Public University may be eligible to transfer prior state service credit, leave balances, health insurance, and/or PERS/ORP retirement information. The timely coordination of the Oregon Public Universities (OPU) Benefits/Accrual Verification Form will need to occur. Please contact SOU Human Resources for assistance at hrs@sou.edu or 541-552-8553.

Faculty Under/Overload

In accordance with the APSOU CBA Article 19, when a faculty member ends employment at SOU for any reason – their workload under/overload bank balance must be reconciled to 0, using the overload compensation rate (OCR). If the faculty member ends with a positive balance they will be paid out at the OCR rate. If the faculty member ends with a negative balance they will be charged this amount at the OCR rate. Any faculty under/overloading will be settled upon separation.

Oregon Unemployment Insurance - UI

Unemployment Insurance (UI) benefits may replace part of your lost income. To file a UI claim, you can use the Oregon UI Online Claim System and select 'File Your New Claim' OR by phone at 1-877-File-4-UI (1-877-345-3484). Before you file your claim, be sure you have the following:

- Your name, Social Security number, birth date, and contact information.

- Your complete work history for the past 18 months including:

- employer name(s)

- address(es)

- phone number(s)

- start and end dates of employment for each employer

- Your bank account and routing number, if you want to sign up for direct deposit.

After you file your claim, you will get a confirmation email from Oregon UI. It may take up to four weeks for them to process your claim and confirmation if your claim is approved or denied will come to you through the mail. You can also check the status of your claim by logging into the Oregon UI Online Claim System.

Other helpful resources are listed below:

- Oregon UI Webpage

- Oregon UI Online Claim System

- Oregon UI Claimant Handbook

- How to file UI videos

- Frequently Asked Questions

Should you believe the wages reported to the State of Oregon for unemployment purposes is inaccurate, please contact payroll-services@sou.edu for more information.

Job Seekers - WorkSource Oregon (Rogue Workforce)

WorkSource Oregon can help you search for work, assess your skills, explore careers, and connect directly with local businesses. WorkSource Oregon offers job listings, referrals, hiring events, resume and application assistance, skills workshops, free Internet access for job search, copiers, fax machines, phones, and other equipment. To get started, visit the WorkSource Oregon website. In Southern Oregon, WorkSource Oregon partners with Rogue Workforce, which have a local office in Medford at 119 N.Oakdale Ave. and are available by phone at 541-734-7533.

Employee Assistance Program - EAP

Southern Oregon University, through the Public Employees' Benefit Board (PEBB), contracts with Canopy (formerly Cascade Centers, Inc.) to provide a comprehensive employee assistance program for eligible employees and their dependents. If you are struggling, free confidential help is available through the EAP.

More details about the EAP can be found on the HR Employee Assistance Program webpage.